If you are a marketing professional in the mortgage industry – as an in-house marketer or subcontracted agency for a mortgage company or lending firm – then this detailed whitepaper is for you.

In this guide, we will cover how to market a mortgage company from A to Z, addressing the need to get in front of other financial industry professions (B2B marketing) and homeowners and home sellers (B2C marketing).

We’ll also highlight specific strategies and the best advice from experts in the space. After interviewing four highly successful and experienced industry pros for the Niche Marketing Podcast, we teased out valuable insights and sprinkled them throughout this article.

Four Mortgage Industry Expert Interviews

Here below are links to each expert’s interview, if you want to dive deeper into specific mortgage marketing topics:

- Erina Johnson, Marketing Director of For You Design (FYD)

Episode 1: Mortgage Marketing Expert Reveals Secrets to Generating Leads from Email and Social Media - Nate Broughton, Vice President of Permanent Equity

Episode 2: Unveiling an Expert's Mortgage Lead Gen Strategies: Co-Registration, Ads, and More - Jeff Kuns, Business Development Manager at Finance Studio

Episode 3: Content Marketing Strategies for Building Trust and Authority as a Mortgage Lender - Marisa Carey, Business Development & Marketing Manager at NFM Lending

Episode 4: Secrets to Mortgage Marketing Success Through Mastering Personal Branding

Each interview is packed with valuable marketing insights exclusively for the mortgage industry.

Who Is This Whitepaper For?

This comprehensive article all about mortgage marketing strategy is what you’ve been waiting for if you want to:

- Clearly understand all the terminology and players in the mortgage space

- Learn how marketing is done (well) within the mortgage industry

- Get actionable tips on mortgage lead generation and compelling content creation

- Discover the "best practices" for social media, content marketing, email marketing, co-registration, paid ads, business networking, and more

- See how a local mortgage loan officer has an advantage over huge brands like Quicken Loans, Rocket Mortgage, and Lending Tree

Our Whitepaper Promise

By the end of this guide, you'll have enough knowledge to make sound, informed decisions regarding how to market your mortgage company.

And, if you want bespoke advice, reach out to us at TAG. We matchmake companies pro bono from our pool of vetted marketing agency partners to help you achieve all your marketing and business goals faster.

Okay, now let’s dive in!

Mortgage Industry Overview

Let’s start with the 101 basics and make sure we are on the same page.

If you’re new to this niche in the financial services world, this is a great primer and overview.

If you’re a seasoned mortgage professional, skim and scan down to the sections more heavy on marketing advice specifically about how to market your mortgage company.

Mortgage Terminology

The mortgage industry is the part of the business world that deals with loans for buying residential properties.

Commonly used mortgage-related terms include:

- Residential Properties: Houses, condominiums, townhouses, and other properties that can be used for living.

- Mortgage: A type of loan a potential customer seeks from a bank or lender to help buy a home to live in or rent out to others. The loan is paid back over time, usually in monthly installments with interest. If payments are not made, the lender or bank could foreclose and take the house back.

- Interest Rate: The cost to borrow money (impacts mortgage rates).

- Loan Types: There are many mortgage loan types including: Fixed-Rate Mortgage, Adjustable-Rate Mortgage (ARM), Conventional Loan, FHA Loan, VA Loan, USDA Loan, Jumbo Loan, Interest-only Mortgage, and Reverse Mortgage.

Players in the Mortgage Space

The main people and organizations involved in the mortgage industry include:

- Mortgage Lender: Financial institution, bank, or mortgage bank that offers and underwrites home loans.

- Mortgage Broker: A designation of a company that usually works with several different lenders with whom they can place loans, depending on borrower qualifications or the nature of the desired loan.

- Loan Agent, Loan Officer, Mortgage Loan Originator: Works for the broker or the bank directly. Big banks like Bank of America and Wells Fargo have their own in-house loan officers and loan originators.

- Note: Many refer to all three of these above as "lenders."

- Borrower: A person, or potential client, who wants to buy a home and needs a loan from a lender to do so.

- Real Estate Agent: Professional who helps people buy and sell homes. They often connect borrowers with lenders, providing profitable and "warm" mortgage leads.

- Appraiser: Determines the value of a property, which affects how much money can be borrowed against it.

- Underwriter: Reviews loan applications and decides if a borrower qualifies for a mortgage based on their financial situation.

- Title Company: Makes sure the property title is legitimate and helps with the transfer of ownership.

- Credit Agencies: They provide credit reports that lenders use to assess a borrower's creditworthiness. Credit requirements vary between different lenders.

- Regulatory Agencies: Government bodies that create and enforce rules to ensure fair and safe lending practices.

- Investors: Individuals or institutions that provide the money that lenders use to give out loans and/or purchase mortgage-backed securities on the secondary market (see more below).

- Servicers: Handle the collection of payments and other aspects of managing the loan.

- Secondary Market: "A marketplace where home loans and servicing rights are bought and sold between lenders and investors." It is "extremely large and liquid and helps to make credit equally available to all borrowers across geographical locations." (Source: Investopedia)

All of these players work together to make the mortgage process possible and help clients to buy homes.

Key Audiences for Mortgage Companies

When it comes to where to direct your marketing efforts, Erina Johnson (Marketing Director of FYD) advises that the three key audiences in the mortgage industry are:

- Referral Partners: realtors, real estate attorneys, insurance agents, financial advisors, and contractors

- Closed Clients: people you are currently helped and past clients

- Prospects: potential clients

Check out the full interview with Erina Johnson in Mortgage Marketing Expert Reveals Secrets to Generating Leads from Email and Social Media to learn more about key audiences and marketing advice for the mortgage industry.

Trends in the Mortgage Industry

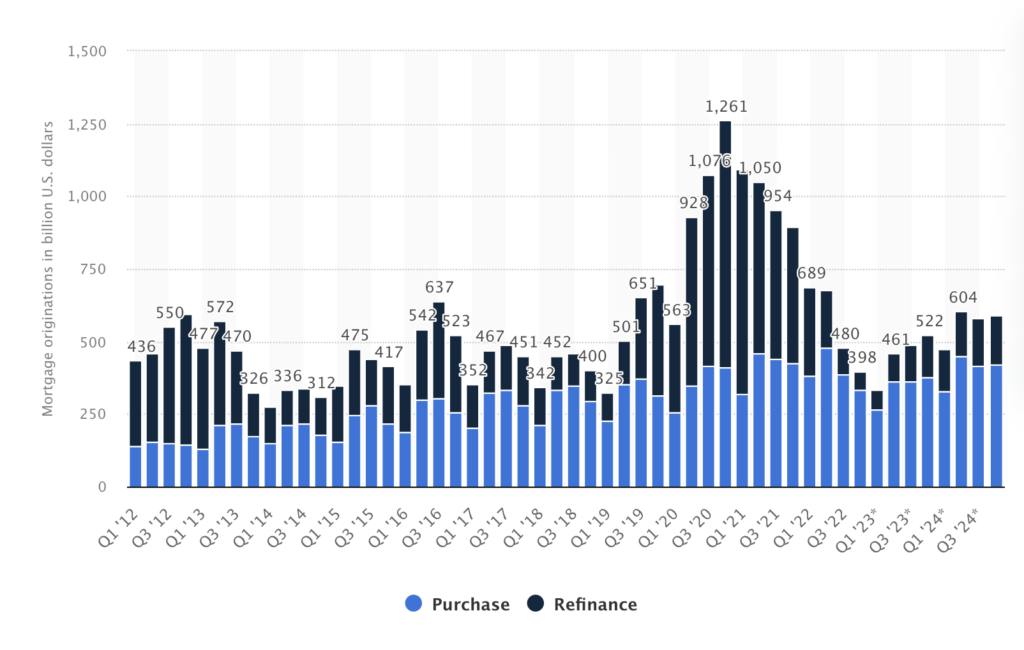

From late 2020 through 2022 the mortgage industry experienced one of the best markets in mortgage and housing history thanks to historically low interest rates (and, by extension mortgage rates) and high housing demand.

(Source: Statista, 2023)

(Source: Statista, 2023)

As the Fed raised interest rates to combat inflation, loan origination and loan refinances cooled. The chart above shows mortgage originations for residential mortgages from the first quarter of 2012 through the fourth quarter of 2022, with forecast data through 2024.

Despite the ups and downs of interest rates, a home mortgage remains the biggest financial decision that most Americans make in their lives.

Deal Size and Opportunity in the Mortgage Industry

According to LendingTree, the average size of a home purchase mortgage obtained through their platform in 2022 was $333,342.

The highest average loan sizes were in the District of Columbia ($561,114), Washington state ($537,741) and California ($520,110). The lowest average loan sizes were in Michigan ($206,581), Indiana ($218,852) and Ohio ($223,264).

If approximately 1% is earned by a lender for loan origination, that's $3,333.42 per deal on average - higher in the District of Columbia ($5,611.14) and lower in Michigan ($2,065.81), as examples.

Clearly, this can be a very lucrative space for a mortgage professional who can master marketing, attract more prospects, turn prospects into borrowers, and turn borrowers into raving fans and referral partners. Speaking of referral partners, effective marketing can also attract other financial professionals (i.e. real estate agents, appraisers, etc.) into your orbit and want to send you more business.

What is Mortgage Industry Marketing?

Because the mortgage brokers who can generate mortgage leads and great deal flow can be very profitable, the industry has become saturated and competitive. Therefore, effective marketing is essential.

Mortgage companies cannot just set up their Google My Business account and expect prospective clients to start calling or top realtors to flood their inbox with hot leads.

So, let’s dive first into all the marketing approaches you can consider for your marketing mix before we share expert recommendations for 2024 and beyond.

Traditional Mortgage Marketing Methods

Traditional marketing methods in the mortgage industry are older ways that mortgage companies use to generate mortgage leads and promote their home loan services.

Some common traditional marketing methods include (in alpha order):

- Billboard Advertising: Displaying mortgage-related ads on large outdoor billboards along roads and highways to catch the attention of drivers and commuters.

- Cold Calling: Contacting a potential customer by phone to discuss mortgage solutions and answer questions.

- Direct Mail: Sending physical promotional and marketing material, such as postcards or letters, to homeowners or potential homebuyers to showcase mortgage offerings.

- Door-to-Door Sales: Visiting homeowners directly to discuss mortgage options and provide information.

- Events and Sponsorships: Hosting or sponsoring events related to home buying or real estate to increase visibility and engagement with potential borrowers.

- Networking: Building relationships with real estate agents and other professionals in the housing industry to gain referrals and partnerships.

- Print Advertising: Placing ads in newspapers, magazines, brochures, and flyers to inform people about available mortgage options.

- Public Relations: Managing the reputation of the mortgage company through media coverage and press releases, highlighting successful cases and community involvement.

- Radio Advertising: Running advertisements on radio stations to reach listeners who might be interested in mortgages.

- Television Advertising: Creating commercials about mortgage services to be shown on TV during relevant programs.

- Trade Shows and Exhibitions: Participating in events related to real estate and finance to showcase mortgage services to a targeted audience.

- Word of Mouth: Relying on satisfied customers and professional partners to recommend your mortgage company to friends, family, acquaintances, and business contacts.

While digital marketing methods (reviewed next) have become more popular, many mortgage companies still use these traditional strategies to reach specific audiences and establish a local presence.

Digital Marketing Methods

The COVID-19 pandemic further accelerated market digitalization in all industries, and mortgages were no exception. With modern borrowers and consumer clients preferring quick online solutions due to their convenience.

Customers now seek to compare different rates, read testimonials, and even apply for a mortgage loan online, never having to leave the convenience and safety of their homes. Plus, top real estate agents and other referral partners want to refer their clients to lenders they know will deliver what a potential client truly wants.

Here is an overview of some commonly employed digital marketing strategies (in alpha order):

- Content Marketing: Creating useful and relevant articles, blog posts, videos, and guides about mortgages to showcase expertise and attract potential customers.

- Email Marketing: Sending emails to people who have shown interest in their services, providing updates, tips, and offers (this is even more effective and time efficient with some marketing automation built in).

- Google My Business: Now also referred to as Google Business Profile, this helps your mortgage business to increase its visibility on Google, gain credibility with online reviews, and control your business information.

- Lead Buying: Mortgage lenders can pay a fee to acquire the contact information of potential borrowers. The fee can vary based on the quality of the lead and the specific criteria requested by the lender.

- Live Chat and Chatbots: Offering instant support and answers to visitors on their websites, improving user experience.

- Online Reviews and Testimonials: Encouraging satisfied customers to leave positive reviews online, which can build credibility, attract new borrowers, and reassure referral partners.

- Pay-Per-Click (PPC) Advertising: Placing ads on search engines and other websites, and paying only when someone clicks on their ad (for example, a Google ad or Bing ad - make sure your Google My Business is optimized first).

- Retargeting: Showing ads to people who have visited your website but didn't take action, reminding them about your services.

- Search Engine Optimization (SEO): Making their websites show up higher on search engines like Google so that when people search for mortgages, they find their services easily.

- Social Media Marketing (organic): Using platforms like Facebook, Instagram, TikTok, and LinkedIn to connect with potential borrowers and share informative content.

- Social Media Marketing (paid): Using social platforms to run targeted ads (i.e. Facebook ads, Instagram ads, TikTok ads, LinkedIn ads, etc.)

- Video Marketing (organic): Using videos to explain mortgage processes, share success stories, and build trust with potential borrowers. The most popular platform to distribute videos is YouTube. These videos can then be shared to other social networks and embedded on your mortgage company's website.

- Video Marketing (paid): Running paid traffic to your organic video ads and/or pre-roll YouTube ads targeted based off of prospective client search history can be very effective too.

- Webinars and Online Workshops: Hosting virtual events where they can educate potential borrowers about different mortgage options.

By using digital marketing strategies, mortgage lenders aim to reach more people, build trust, and stay visible and ‘relevant’ in an increasingly digital world.

Ultimately, when done well, a mortgage broker will attract customers who are looking for home loans and more real estate agents and other financial industry professionals looking for a savvy mortgage loan officer to whom they can send potential customers.

Mortgage Marketing Overwhelm

We have shared a myriad of ways to promote your mortgage company via traditional and digital marketing methods. Yet, with so many ways a mortgage company could nurture its inbound marketing and generate more quality leads, it can be overwhelming to decide what to focus on.

The Agency Guide understands every facet of mortgage marketing and can help with a free consultation, if you’d like to talk out these marketing ideas with experienced pros.

In the next section, we dive into recommendations and best practices from our expert mortgage marketing guests that we mentioned at the beginning of this guide!

Okay, let’s get to the juicy stuff.

Top 5 Mortgage Industry Marketing Strategies

The Challenge:

Potential clients (your B2C prospects) and professional partners (your B2B prospects) are more informed than ever, and they expect high-quality, personalized experiences and quick communication across multiple channels–from email to social media to text messaging to voice or video calls.

People are also overwhelmed by spam calls and are wary of unsolicited contact via door knocking, phone calls, and email.

Therefore, buying leads and cold reach outs are not the ideal lead generation or mortgage marketing strategies. Plus, top-quality leads are expensive to buy and not always ‘exclusive’–high cost and high competition.

The Solution:

So, what are effective marketing strategies for lending professionals? Glad you asked!

Let's dive into my top five marketing strategies that work best for the mortgage industry today:

1. Social Media

2. Content Marketing

3. Email Marketing & Co-Registration

4. Paid Advertising

5. Building Relationships

First up: social media!

1. Social Media in Mortgage Marketing

As Marisa Carey, Business Development & Marketing Manager at NFM Lending, said in Episode 004 of the Niche Marketing Podcast (at about timestamp 09:30), “I can understand your want to buy leads…but everybody wants to work towards a referral business, right?”

So, how can a mortgage professional build a referral business with modern mortgage company marketing?

Marisa Carey went on to say, “...the only way of doing that is continuing to build your network. And right now, especially in today's day and age, the way of doing that is through social media.”

We agree.

According to Forbes, “In 2023, an estimated 4.9 billion people use social media across the world.”

And this number is going nothing but up.

Which Social Media Platform Should Mortgage Companies Use?

The Forbes article also points out that people (i.e. prospective clients and professional partners) aren’t tied to a single social platform:

“The average user now spreads their digital footprint across a staggering six to seven platforms every month–highlighting the need for a multi-platform approach to social media.”

At the time of this writing, the best platform for organic traffic to the most relevant target audience for a mortgage professional is LinkedIn, especially on the B2B front.

In B2C, the best platform for organic traffic is TikTok if you are targeting first-time homebuyers who are typically from younger generations. But if you specialize in reverse mortgages, your best bet is with Facebook where older generations spend time and scroll more slowly through their social feeds.

Depending on where your audience engages most and which social media platform you are most comfortable posting, the type of content that packs the biggest promotional and brand-building punch is video, which also should put YouTube (videos of all lengths) and YouTube shorts (videos under 1 minute) on your radar.

What Type of Content Should Mortgage Brokers Share in Marketing?

“Videos are number one,” said Marisa Carey during our podcast interview, based on her expertise in both mortgage lending and social media.

When it comes to social media marketing, video content outperforms for both paid and organic campaigns, that is, if it’s engaging. A boring or badly made video will not drive quality leads or sales just because it is a video.

Watch the full episode here:

And keep reading for more!

Best Advice for Making Video Content to Grow My Mortgage Business?

“As a loan officer, you're constantly on the go…you're constantly on the phone, you're constantly behind your computer working numbers. Your days are really busy,” acknowledged Marisa Carey.

Finding the time, consistently, to create video content can be very challenging for mortgage professionals, especially in the beginning. Here are some social media marketing best practices.

1. Schedule Time for Content Creation

Set a schedule and batch-creating content you can then trickle out and share over time. Make sure to put it in your calendar so you have time carved out for it.

And, before you say you don't have time, look at all the small time-wasters you do throughout the day. A funny video here, checking your text messages (again) there, getting sucked into social media scrolling–cut out the unimportant to make room for the things that will grow your business.

2. Mix Up the Content Topic Types

Here are a few ideas that mortgage brokers could create video or other content around:

- Share market updates around mortgage rates, popular loan types, economic conditions, and local policy changes that can affect homeowners

- Educate about the mortgage process and specific products

- Share client case studies (with permission)

- Tell behind-the-scenes stories about what it's like to be a mortgage loan originator

- Answer commonly asked mortgage-related questions

- Explain more advanced concepts like “what is a secondary market?”

- Talk about the benefits of working with a mortgage lender instead of something impersonal like Quicken Loans

- Share checklists for the home buying process, what to look for in a great real estate agent, or tips for improving credit scores

3. Make Creating Content Easier

If you feel a bit camera-shy, we have found a great ‘hack’ is to script out what you are going to talk about and use a teleprompter. A bit of work planning out the video goes a long way to making the end result more valuable to the watcher, faster to record, and quicker to edit.

As Marisa Carey shared (at timestamp 19:13), talking about loan officers and real estate agents she helps with social media platform strategy and content creation:

“When they come in prepared, it might take them anywhere from three to five takes. They're not coming prepared? We've gotten upwards of 40 takes because you don't know what you want to say. You get nervous because you don't know what you want to say.”

4. Be Authentic

The word “authenticity” is thrown around a lot, but it just means to be yourself. How can you do this and ensure your videos will pull people in?

- Be a high-energy version of the real you

- Don’t take yourself too seriously

- Don’t pretend or fake anything

As Marisa Carey aptly put it, “Don’t fake it ‘til you make it—face it ‘til you make it!”

And remember, the more you do it, the more natural it will feel, and the more fun you will have with social media content creation.

5. Get Help

Creating content for social media all alone can feel overwhelming, intimidating, and, quite frankly, boring. So don’t feel like you have to work in a vacuum. Enlist the help of someone you trust and have rapport with to bounce ideas off of, work the video equipment, and/or do some of the editing.

6. Smile

Remember to smile. The warm generated by smiling will make the viewer actually want to watch the video and feel more connected with you.

7. Don't Be Afraid to Experiment

In order to find what works for you and your audience, be open to trying different things.

For example, if you are struggling with face-to-camera videos, try voiceover videos where you talk and teach while showing articles, stats, b-roll video footage, or other interesting things on the screen.

“Do your research and look at different videos online,” advised Marisa Carey about 23 minutes into the episode.

“Try a few different things by yourself first and see what makes you most comfortable. And maybe it's just you taking your camera and recording yourself this way while you're trying to do it. You have nobody else around. Adding other people only increases your likelihood of messing up.”

- Marisa Carey, Business Development & Marketing Manager at NFM Lending

8. Get Personal

You are in control over how much you share about yourself and your family, but people want to work with people.

You can’t build the know-like-and-trust factor with someone you can’t get to know.

“I always like to say building your brand is not just posting about real estate because people want to work with people that they like. And if they can't relate to you outside of you being a mortgage lender, they're likely not going to want to work with you.

So I always say, like, for me, it's like the rule of three. Posting at least three different things on your stories daily that have nothing to do with the mortgage industry.

For me, it's fitness, it's food, and it's quotes.

Those are the top three things for me that I think I relate to most and people relate to most. And I'll tell you right now, when I post a house versus when I post my breakfast in the morning, I get probably about 50% more people reaching out to me about my breakfast than about the house I listed.”

- Marisa Carey, Business Development & Marketing Manager at NFM Lending (about 27 minutes into our conversation)

9. Think Like a Branding Company

To show up looking polished, consistent, and instantly recognizable, think like a branding company and make sure to select and use the same colors, fonts, and logos throughout different content pieces from recently sold posts, to new listing videos, to testimonials, and beyond.

Even a small business can look like a bigger institution in terms of professionalism, if it shows up with a polished brand identity and cohesive marketing material.

Want More?

To dive deeper on social media content creation for your mortgage business, watch or listen to the full episode with Marisa Carey, Business Development & Marketing Manager at NFM Lending, here: Episode 004: Secrets to Mortgage Marketing Success Through Mastering Personal Branding.

If you need help with this or any other marketing ideas discussed, please reach out to TAG for a free consultation.

2. Content Marketing in the Mortgage Industry

In addition to the importance of creating content for social media to stay top-of-mind, build brand awareness, and attract potential customers and referral partners, it is also important to have a strategy around creating content that lives on your owned media channels (like your website).

When done well, this content achieves multiple objectives because it:

- Educates and/or entertains prospective clients

- Helps your website rank well in search results, which can help you generate more leads, clients, and referral partner opportunities (a.k.a. Search Engine Optimization or SEO), especially in local markets

- Establishes you as an authority in your industry (this is especially for smaller, more regional players in the mortgage industry trying to compete with big banks and lending companies backed up by insane SEO structures and big advertising dollars)

- Retains visitors looking for help with the mortgage process on your website longer

- Can attract quality linkbacks from other blogs and websites, further strengthening your SEO, domain authority, and notoriety in the mortgage industry

We recently sat down with Jeff Kuns, Business Development Manager at Finance Studio, to discuss what really works when it comes to content marketing in the mortgage vertical.

Kuns was quick to answer with: “SEO-optimized, long-form content is really where we spend a lot of time.” (Timestamp: 19:02)

Here's the full episode with Jeff Kuns:

What is Longform Content?

Long blog posts (like this very white paper that you are currently reading) allow you to delve into various topics, such as industry news and trends, tips on saving for a down payment, and new loan options. A detailed article also provides additional SEO opportunities, as each blog post can be optimized with specific keywords related to your company, which in turn increases your search engine results page (SERP) rating and leads to more opportunities.

Pro tip:

Make sure your website is optimized for mobile viewing, has no issues slowing down its speed or loading time, and is user friendly in terms of navigation and organization of your content.

Content Marketing Ideas for the Mortgage Industry

In terms of B2C, prospects looking into the home loan process are hungry to learn and terrified of making a mistake. They fear overpaying for their loan because of high fees or not understanding mortgage rates, so they are looking for clear, detailed information to help navigate through the mortgage process.

Therefore, creating a ‘library of content’ to help borrowers in each stage of the process can be a content marketing boon for your small business and brand.

For example, here’s a great content idea for borrowers: craft a detailed step-by-step guide to relocating to your area. Even if, as a mortgage loan officer or lender you only help with part of the process outlined in your guide, the prospective client will see you as a trusted advisor and source of quality information.

Portions of the detailed guide you might create could then also be chopped up and repurposed into other marketing material. And, if it generates a lot of organic traffic, put some Google ad spend budget toward driving paid traffic to your business too.

But, we’re getting ahead of ourselves. We’ll dive more into paid advertising in the fourth mortgage marketing strategy in this whitepaper.

On the B2B side of things, we have found it very effective to create content that provides your referral partners with resources, training, and or educational content about the mortgage business' unique products or industry trends.

Provide value as much as possible and establish your company as a reliable business your referral partners would be comfortable recommending to their clients.

If you don’t have time to create all the content yourself – or are not a strong writer – start by recording audio (like a podcast or voice memo) or video and having the content transcribed and cleaned up for publishing.

Outsourcing content creation is also a possibility. However, the content should be written by someone with actual financial experience.

“Number one is that you have actual mortgage experience or somebody writing for you that has actual mortgage experience.” — Jeff Kuns

Content marketing also plays a crucial role in your email marketing efforts, as it allows you to deliver meaningful content via newsletter and stay top of mind with your referral partners and potential clients.

Note:

To hear the full conversation with Jeff Kuns, Business Development Manager at Finance Studio, visit: Content Marketing Strategies for Building Trust and Authority as a Mortgage Lender

3. Email Marketing and Co-Registration in Mortgage Marketing

Speaking of email marketing, we highly recommend this digital marketing strategy for your mortgage industry business. Use it to stay top of mind with all of your key audiences.

What are your key audiences? As marketing expert Erina Johnson, Marketing Director of FYD, shared in our full conversation on Generating Leads from Email and Social Media:

“Your three key audiences are referral partners, that'll be realtors, real estate attorneys. Then you have your closed clients, the people you've already worked with before. And then finally you have your prospects, so first-time buyers.”

Email Marketing

We have found marketing via email to be a great way to keep in touch with and provide value to all types of key audiences. After signing up for a weekly newsletter, for example, set up automations that send valuable content each week.

What should you send? These emails can be economic announcements, common questions that a potential customer might ask during holiday periods, and/or any new products the mortgage company is releasing.

Newsletters should be both informative and engaging. In an effective email marketing campaign, your recipients look forward to getting your emails and would actually reach out to ask, “What’s wrong!?” if they didn’t get one.

By leveraging marketing automation tools, your evergreen email content can be prewritten in advance – or batched – and set up to trickle out over time.

Email Marketing Idea: The annual review.

Via email, reach out to clients once a year to discuss their mortgage, provide updates or information about their loan, answer questions, and offer any advice, if necessary.

The same approach can be employed with professional partners to stay in touch and provide ongoing value, which may lead to referrals and repeat business.

After sending out the annual review as an email with updates that apply to everyone, follow up with a phone call to check in on your partners, past clients, and hot leads.

Hear more insights from Erina Johnson, Marketing Director of FYD, in Episode 001: Mortgage Marketing Expert Reveals Secrets to Generating Leads from Email and Social Media.

Co-Registration

Co-registering is when you team up with another company and allow a consumer to opt-in for multiple offers while registering for one primary offer. For example, mortgage companies could team up with a real estate agent to create microsites and landing pages for specific target audiences to generate leads for both partners.

Any time you acquire new leads, add them into your email marketing campaigns, based on their interests, location, or stage in the loan process.

Great ideas on co-registration and lead generation are covered with our full conversation with Nate Broughton, Vice President of Permanent Equity, in Episode 002: Unveiling an Expert’s Mortgage Lead Gen Strategies: Co-Registration, Ads, and More.

4. Paid Advertising in Mortgage Marketing Strategy

As we have been discussing in this whitepaper, having a strong online presence in today's digitally-oriented world is essential for any business.

So far, we have focused more on organic methods of lead generation and brand building, but, as we dove into with Nate Broughton in Lead Gen Strategies: Co-Registration, Ads, and More, the complete guide to marketing would not be complete without a look at paid advertising.

What is PPC Advertising?

Pay-per-click (PPC) advertising or paid ads can be an effective marketing component of your overall plan. We’ve found Google Ad campaigns for search and Facebook ads, Instagram ads, and Linkedin ads in social media advertising to be especially fruitful.

Paid advertising can work better and faster than organic SEO since large institutional companies like big mortgage banks have such a dominant foothold on search results. Plus, ads can be highly effective because they allow you to reach customers who are actively searching for mortgage solutions. We have found targeting certain demographics, locations, and even devices used by target audiences to be very effective.

We have found that PPC ads help tailor digital marketing efforts to reach the most relevant prospects.

Where Should I Start with Paid Advertising for My Mortgage Business?

It can be overwhelming to decide where to allocate resources for mortgage lead generation via paid ads. To start, consider using the platforms that you are most familiar with, whether a Google ad in search or Instagram ads, Facebook ads, Linkedin ads, or even Twitter ads in social.

While this is fantastic advice, each company is different and it can feel challenging to decide where to start since the best path depends on your size, location, target audiences, budget, and goals.

Please reach out if you are open to outsourcing your paid ad strategy to marketing professionals. The Agency Guide has over 200 vetted partners, so we can match you with the perfect agency to make sure you are ROI-positive on ad spend.

5. Building Relationships in Mortgage Marketing Strategy

No overview of effective marketing strategy in the mortgage world would be complete without looking at building relationships with local professionals, real estate agents, and other mortgage loan officers.

We talked about building relationships with real estate agents and other professionals in my podcast episode with Marisa Carey, Business Development & Marketing Manager at NFM Lending. Real estate agents are often the first professionals that homeowners and homebuyers talk to when they want to sell or buy a home. So, they're in a perfect position to recommend mortgage business to a mortgage broker they trust.

And, although digital marketing is incredibly valuable for your mortgage marketing toolkit, smaller lenders, boutique mortgage brokers, and local mortgage loan officers have a huge advantage over the big players in the space like Quicken Loans, Rocket Mortgage, and Bank of America.

“Even though [big institutional lenders] might have a local presence, local brokers tend to have more activity with local CPAs–like, I built my business with CPAs and financial advisors. So, I was always talking to them or seeing them at events locally.”

- Jeff Kuns, Business Development Manager at Finance Studio, in his expert interview with me at timestamp: 11:30.

When it comes to your goals on how to market a mortgage company, bigger isn't always better.

“Trust is a big deal when it comes to that size of a loan. And, here in Los Angeles, we’re talking $600,000-plus usually, right? So, there’s opportunity in staying in touch with those clients....

Smaller firms have a great opportunity because they can get in front of those clients, they can follow up with them, and most people don’t. I mean, most businesses don’t…I read they’re leaving about 35% or more of their revenue on the table just by not following up, upselling, cross-selling, and those kinds of things.”

- Jeff Kuns (timestamp: 16:58)

We at The Agency Guide have built our entire business upon trust, partnership, and passing high-quality referrals. If we can be a (free) resource to you in helping you achieve any of your marketing or growth goals by leveraging our network to your benefit, please reach out.

Measuring and Analyzing Marketing Efforts

Although there is no guaranteed magic wand when it comes to marketing success, if you implement the five strategies we have covered in this deep dive whitepaper on how to market a mortgage company you are off to the best start possible. After executing your marketing plan, continue to learn and iterate, and you’ll hone in more and more on what works for you.

To review, here are our five favorite strategies for mortgage company marketing today:

- Social Media

- Content Marketing

- Email Marketing & Co-Registration

- Paid Advertising

- Building Relationships

However, like all good things in life and business, we must pay attention and make adjustments to what we’ve set in motion in order to make sure our efforts are working and our business is growing.

We recommend a data-drive approach to monitoring the effectiveness of marketing efforts so that you can make informed decisions. Many small business owners and marketers fall into the trap of relying only on opinions and personal preferences rather than letting the data be the guide.

So, set up key performance indicators (KPIs) to measurable values of effectiveness. Examples of KPIs we have found benefit in monitoring include:

- number of mortgage leads generated

- conversion rates of paid ads

- email open rates

- cost per lead

- video view counts

- lifetime value of an average client

- number of quality leads referred

Make sure to use tools like Google Analytics to measure your website's performance, what content is attracting the most traffic, where visitors are coming from, where prospects are ‘bouncing’ off your website, and more.

To learn more about marketing from all angles, check out TAG's other blog content.

Compliance and Legal Considerations for Mortgage Marketing

Because the mortgage industry is very heavily regulated by The Real Estate Settlement Procedures Act (RESPA), the Truth in Lending Act (TILA), the Fair Housing Act, and the Equal Credit Opportunity Act (ECOA), a detailed article about how to market a mortgage company would not be complete without acknowledging compliance and legal considerations.

Financial industry scrutiny spills into marketing practices for lenders. Therefore, your mortgage business needs to familiarize itself, adhere to, and stay on top of current and changing industry regulations.

For example, the Consumer Financial Protection Bureau (CFPB) permanently shut down mortgage loan businesses that advertised using unauthorized Veterans Affairs (VA) seals and FHA logos.

Rightfully so!

However, in certain regions, the CFPB also bans financial institutions from claiming that their financial product is “the best,” which is something to be aware of in the mortgage marketing space.

Violation of regulations can lead to hefty fines and severe legal repercussions.

Another example is that the Truth in Lending Act requires lenders to disclose specific information in their ads, including loan terms, conditions, and APR. Misleading or false advertising can bring severe penalties.

It's essential to ensure all your marketing materials, from your website content to your social media ads, comply with these guidelines.

Elevate Your Mortgage Company's Marketing Success

We at The Agency Guide understand the complexities and nuances of standing out in the crowd and being a beacon that attracts the perfect mix of potential clients and referral partners to help you grow your business.

If you want more help with how to market your mortgage company, we can connect you to marketing agencies that best suit your business's unique needs and goals.

If you're ready to elevate your marketing efforts to new heights, and achieve unprecedented success, don't hesitate to contact The Agency Guide - pro bono.

We're here to support you.